-

Product Management

Software Testing

Technology Consulting

-

Multi-Vendor Marketplace

Online StoreCreate an online store with unique design and features at minimal cost using our MarketAge solutionCustom MarketplaceGet a unique, scalable, and cost-effective online marketplace with minimum time to marketTelemedicine SoftwareGet a cost-efficient, HIPAA-compliant telemedicine solution tailored to your facility's requirementsChat AppGet a customizable chat solution to connect users across multiple apps and platformsCustom Booking SystemImprove your business operations and expand to new markets with our appointment booking solutionVideo ConferencingAdjust our video conferencing solution for your business needsFor EnterpriseScale, automate, and improve business processes in your enterprise with our custom software solutionsFor StartupsTurn your startup ideas into viable, value-driven, and commercially successful software solutions -

-

- Case Studies

- Blog

5 Hot Trends That Will Impact FinTech in 2018 and Beyond

A survey by Blumberg Capital shows that 57 percent of Americans believe that today’s financial institutions will completely change within their lifetimes. At the same time, 70 percent think that FinTech solutions are improving their financial health.

To gain a competitive edge for your FinTech startup, you have to keep up with the latest technology trends. In this article, we talk about the most significant FinTech trends.

The financial services industry will see more change in the next 10 years than it has in the last 100. And that transformation is being driven by a group of smart insurgent startup companies.

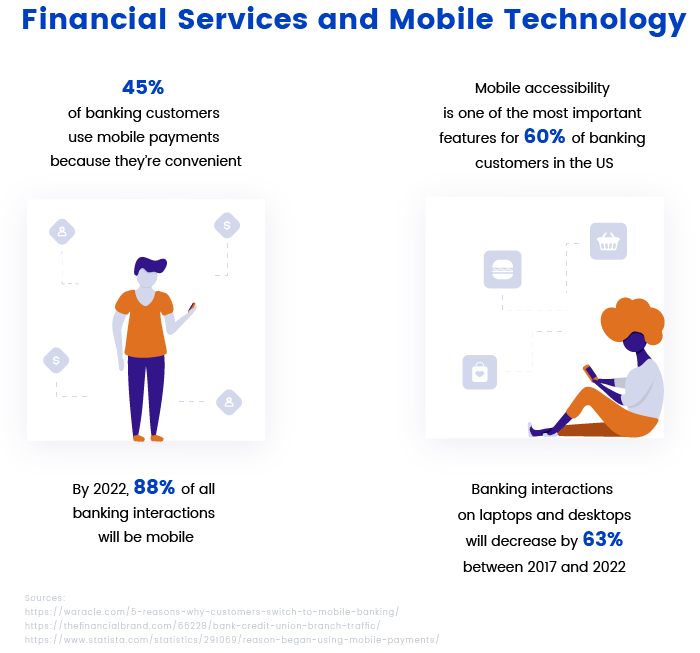

Financial services are going mobile

Mobile technology has made an impact on lots of industries, including the financial services industry. With today’s pace of life, many see the possibility to use banking services on the go as a huge advantage. And FinTech should keep up with this trend.

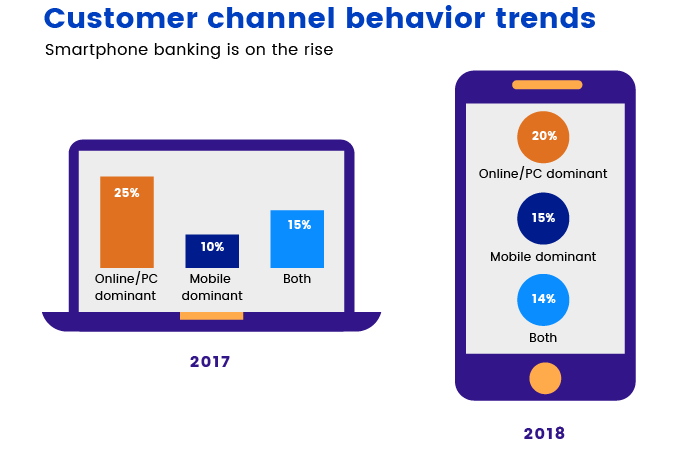

According to PwC’s 2018 Digital Banking Consumer Survey, in 2017, 25 percent of customers preferred to interact with their banks digitally without a preference for using one specific device, while 10 percent preferred using their smartphones. Between 2017 and 2018, there has been a 5 percentage point increase in the share of customers who prefer to use their smartphones for banking.

As you can see, the number of people who prefer using smartphones for banking interactions is rising. Mobile apps provide a number of benefits for both banks and customers, such as cheaper transactions and cost savings compared to running physical branches. Using a banking app, customers can manage their finances quickly and easily.

Moven, for instance, is an app that lets users manage their finances. The app also tracks spending to show how much a customer has spent within a month and sends alerts if they spend more money than usual.

Monzo, a digital bank, offers customers an app that lets them manage their money, see an account overview, get notifications, freeze a card, and send money abroad.

Digital-only banks

Today, banks can meet their customers’ needs through digital platforms. As a result, we’re witnessing a growing number of digital banks that have no physical branches and provide financial services with the help of apps. Digital-only banks are particularly popular among Millennials, who prefer to use mobile banking services that let them create accounts and make financial transactions using mobile devices.

For instance, the digital bank Revolut provides a finance app that enables currency and cryptocurrency exchange. The app helps users control their finances by setting up a budget and tracking their daily spending limit. It also categorizes payments so that users can see what they spend the most money on. As of 2018, Revolut has more than 2 million users and gets between 6,000 and 8,000 new customers every day.

The mobile bank N26 allows its customers to open a bank account and manage money using their mobile devices. With the app, users can block their card and set limits. In 2017, N26 hit 500,000 customers and managed to double that number in just nine months. The company plans to expand beyond Europe and expects to have 5 million customers by 2020.

Startups already can compete with established banks, providing an improved customer experience. Visits to bank branches are expected to drop 36 percent between 2017 and 2022, while mobile transactions are expected to grow 121 percent in the same period.

Privacy and security

There are lots of concerns about privacy in the digital age. That’s why greater security is one of the top priorities for today’s FinTech companies.

According to a report by CB Insights, in 2017 the financial services industry saw more cybersecurity incidents than any other industry.

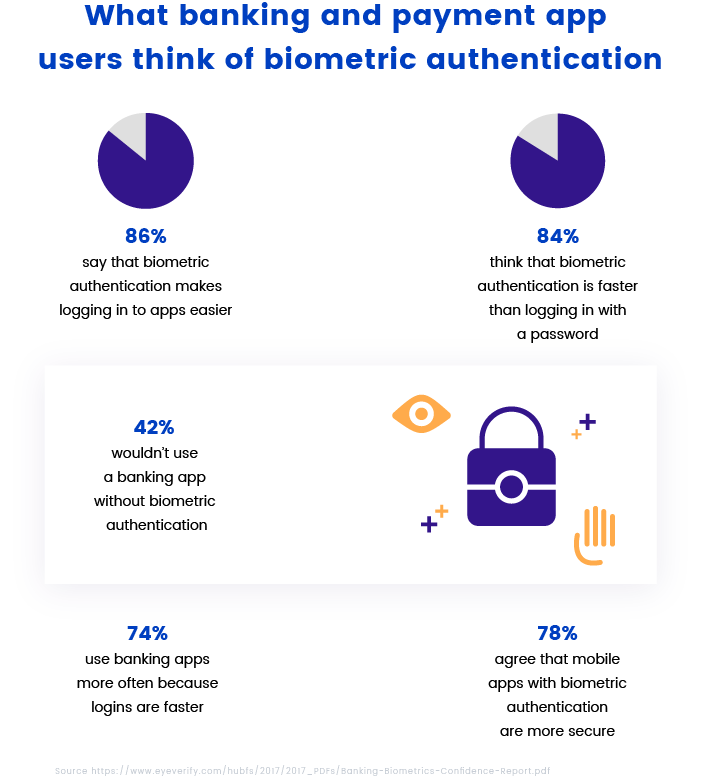

The financial services industry is adopting biometric technologies as one way to prevent fraud and hacking. Moreover, biometric technology makes logging in to a banking app not only safer but also faster.

As you can see, most banking app users already prefer biometric authentication. According to experts, the PIN number will vanish by 2020 because banks will replace it with biometric authentication using fingerprints, iris scans, facial recognition, palm vein patterns, and voice recognition.

Mastercard claims that all of its customers will be able to use biometric authentication by April 2019.

Biometric technologies perfectly meet the public’s expectation for state-of-the-art security when making a payment.

Atom bank, a mobile-focused bank, also uses biometric technology. When an Atom bank customer creates an account, they get a VoiceID and FaceID. This allows them to log in to the app using voice and face recognition. Significant transactions also require biometric verification.

Blockchain

The financial services industry was one of the first to implement blockchain technology. Currently, the industry spends $1.7 billion on blockchain technology each year.

Some 90 percent of major North American and European banks are exploring the blockchain for payments. According to an IBM study, about 65 percent of banks are expected to use blockchain technology by 2019.

Blockchain companies are attracting a lot of attention today. Forbes FinTech 50 2018 includes nine startups that use blockchain technology, among them Coinbase, a cryptocurrency exchange platform. Coinbase is currently valued at 8 billion US dollars.

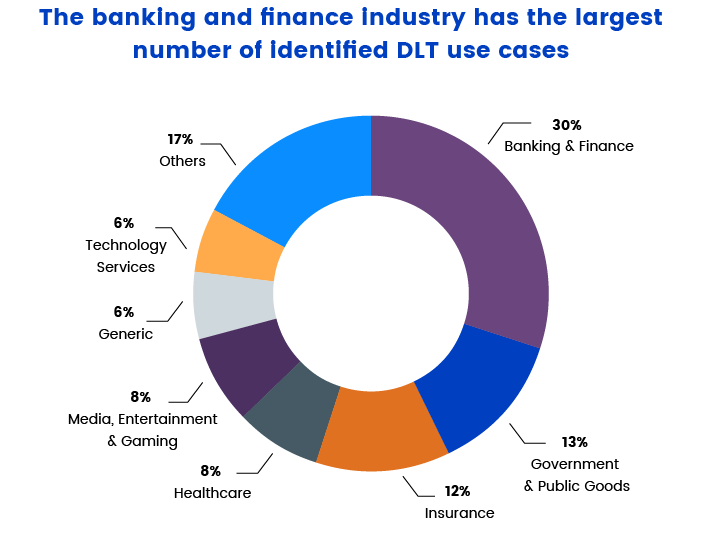

Financial institutions are interested in the blockchain because of the security and transparency the technology provides. Moreover, smart contracts can automate payments and other financial operations. As the 2017 Global Blockchain Benchmarking Study shows, the banking and finance industry uses distributed ledger systems more actively than other industries.

Banks and financial organizations started exploring the blockchain not so long ago. But considering the interest they show and the solutions this technology offers, we can expect the blockchain to make a big impact on FinTech.

Artificial intelligence

Artificial intelligence is already making an impact on the future of FinTech. As the Global FinTech Report 2017 states, 30 percent of large financial institutions are investing in artificial intelligence.

According to a report by Econsultancy and Adobe, 20 percent of financial services organizations are already using AI, while 41 percent are planning to use it within the next 12 months. There are a number of reasons the financial services industry is adopting AI:

- To automate tasks such as data analysis. For example, JPMorgan Chase uses the COIN system to review legal documentation. Automation helps eliminate human error and cuts the time spent on legal work. COIN needs just several seconds to review a quantity of commercial loan agreements that previously took lawyers about 360,000 hours each year.

- To offer financial advisors (robo-advisors). One example of a robo-advisor is Olivia, a financial assistant that helps customers manage their finances. By learning about customers’ habits and analyzing spending, Olivia recommends ways to save money.

- To facilitate customer interactions. More and more banks are implementing chatbots to streamline operations with customers and reduce routine work. AI-powered chatbots efficiently increase customer engagement, and 86 percent of financial institutions believe that chatbots can help them engage Millennials.

- To detect fraud. Financial security is still an issue today, and AI has the capabilities to make financial services more secure.For instance, machine learning algorithms can monitor patterns of customer behavior and detect which actions might be fraudulent.

The bottom line

The strong trend in recent years is toward mobile banking and the use of smartphones to perform daily banking operations. Smartphones allow people to manage money easily without going to a physical branch. Millennials are the main target audience of mobile banking services. This trend has also led to a growing number of digital-only banks that provide a full range of financial services through apps.

But with this digital transformation, the financial services industry has become more vulnerable to cyberattacks. That’s why implementing biometric authentication, AI solutions, and the blockchain to increase security is a growing FinTech trend. The blockchain is attracting a lot of interest as blockchain technology also provides a number of advantages including transparency and automation.

Another FinTech trend is adopting AI. According to a report by Mediant, most financial experts agree that AI and machine learning will be the most impactful FinTech innovation in the next few years. This technology is already used to automate tasks like data analysis and to create AI-powered chatbots and robo-advisors.

Want to know more about new technologies? Subscribe to our newsletter!