-

Product Management

Software Testing

Technology Consulting

-

Multi-Vendor Marketplace

Online StoreCreate an online store with unique design and features at minimal cost using our MarketAge solutionCustom MarketplaceGet a unique, scalable, and cost-effective online marketplace with minimum time to marketTelemedicine SoftwareGet a cost-efficient, HIPAA-compliant telemedicine solution tailored to your facility's requirementsChat AppGet a customizable chat solution to connect users across multiple apps and platformsCustom Booking SystemImprove your business operations and expand to new markets with our appointment booking solutionVideo ConferencingAdjust our video conferencing solution for your business needsFor EnterpriseScale, automate, and improve business processes in your enterprise with our custom software solutionsFor StartupsTurn your startup ideas into viable, value-driven, and commercially successful software solutions -

-

- Case Studies

- Blog

Top 6 Online Marketplace Metrics You Should Track

Do you know why the most popular online marketplaces are prosperous? Their secret lies in measuring and assessing actionable metrics (otherwise known as key performance indicators, or KPIs). Tracking KPIs is the key to the success of any digital business.

To make the right decisions about growing a marketplace, you need to know what standards to follow. That’s where KPIs come into action. In this article, you’ll discover actionable online marketplace metrics and learn how to track them.

Classification of online marketplace metrics

There are four main types of online marketplace metrics: usage, transaction, business, and user satisfaction metrics.

- Usage metrics show you how many people visit your site and how long they spend on it.

- User satisfaction metrics indicate how your business can improve customer service, build relationships with customers, and decrease the churn rate.

- Transaction metrics show not only the number of transactions (which is a vanity metric) but also allow you to track liquidity, the provider-to-customer ratio, and the repeat purchase ratio.

- Business metrics track marketplace revenue, profitability, and customer acquisition.

| Type of metrics | Marketplace metrics |

|---|---|

| Usage metrics | Monthly active users (MAU) Bounce rate Time spent on site |

| User satisfaction metrics | Net promoter score (NPS) Conversion rate Customer churn rate |

| Transaction metrics | Liquidity Seller-to-customer ratio Repeat purchase ratio |

| Business metrics | Gross merchandise volume (GMV) Customer acquisition cost (CAC) Customer lifetime value (CLV) |

The most important online marketplace metrics to track

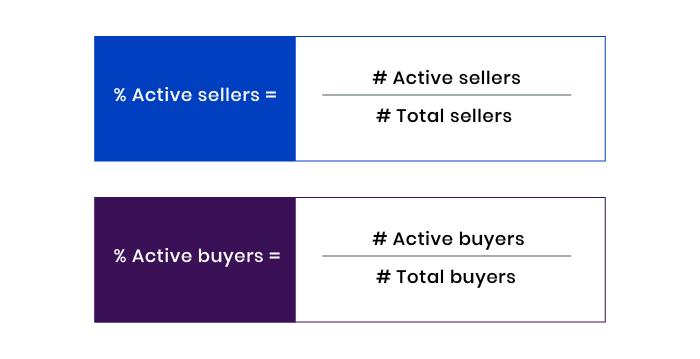

Percentage of active sellers/buyers

This is the percentage of users who have added new listings or bought items in the last 30 days (or some other period).

To calculate the percentage of active users on your online marketplace, use the following formula:

Knowing the percentage of active users allows businesses to:

- Find out how desirable and popular their marketplaces are

- Know that their products are actually useful to their customers

- Assess the customer experience and the effectiveness of marketing campaigns

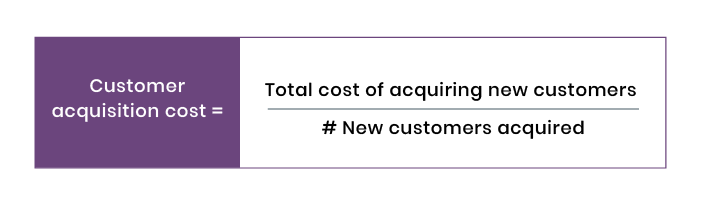

Customer acquisition cost (CAC)

Customer acquisition cost is one of the most important metrics. This online marketplace metric shows the price your business pays to acquire a new customer, including marketing and sales expenses.

Ideally, CAC is close to zero, meaning the audience is growing organically. If CAC rises extremely, entrepreneurs risk running a business that’s not profitable enough. Therefore, it’s critical to measure all business spending and adjust marketing efforts in time to prevent overspending.

You can calculate your CAC using this formula:

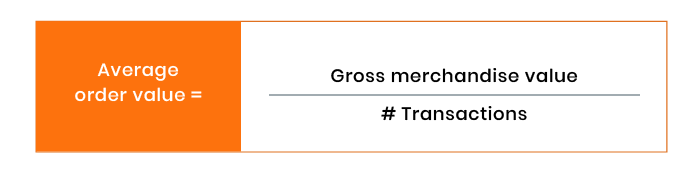

Average order value (AOV)

One more marketplace metric to track is the average order value. This metric is an indicator of how much users spend on a marketplace. To be more precise, AOV calculates the average check size for every order placed.

Average order value can be measured daily, weekly, or monthly. This formula helps you calculate AOV:

With the help of AOV, marketplace owners can get a clear picture of customers’ buying patterns. A high AOV indicates highly planned one-off purchases. A low AOV indicates potentially more impulsive and recurring purchases.

Popular marketplaces like Amazon pay particular attention to AOV, since this marketplace metric provides valuable information about customers’ habits, order updates, and market trends. Knowing your AOV can lead to a sustainable business model for your online marketplace.

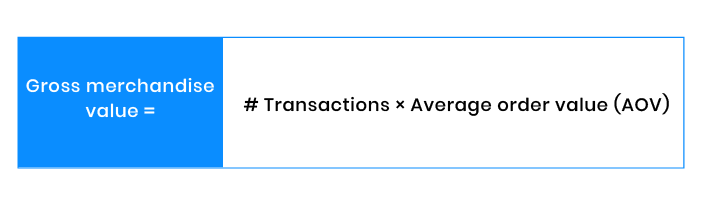

Gross merchandise value (GMV)

Gross merchandise value measures the total value of goods and services sold on the marketplace platform. In short, it shows the actual growth of a marketplace by tracking how much money flows into the platform over a certain period of time. It’s better to track GMV early on and analyze it systematically. To measure GMV as accurately and reliably as possible, calculate it after cancellations and returns.

Here’s how to calculate GMV:

GMV provides businesses with valuable insights:

- How popular the online marketplace is

- How well the marketplace is performing

- If the marketplace is worth investing in

GMV is a predictor of an online marketplace’s success and provides information to measure its growth.

Take rate

The take rate allows marketplace owners to get an accurate view of revenues. In short, this metric shows the net revenue a platform gets from commissions, fees, and any other monetization strategies.

Use the following formula to calculate your take rate:

A high take rate indicates the marketplace offers a solid and exclusive value proposition to both buyers and sellers in a given segment.

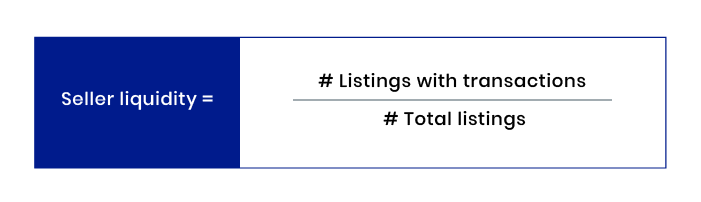

Liquidity

When it comes to an online marketplace, it’s essential to find out how liquid (or “transactional”) buyers and sellers are. Liquidity is one of the most important online marketplace metrics. This marketplace KPI shows how demand and supply work on your marketplace.

Seller liquidity demonstrates the percentage of listings that result in transactions within a certain time period.

Let’s see how to calculate seller liquidity:

However, for different types of marketplaces, seller liquidity is calculated a little differently. Let’s consider how this works in practice:

- Uber calculates the percentage of drivers on duty that are giving a ride at any given time

- Etsy measures the percentage of products available that are sold in a month

- Airbnb tracks the proportion of rooms that are booked each night

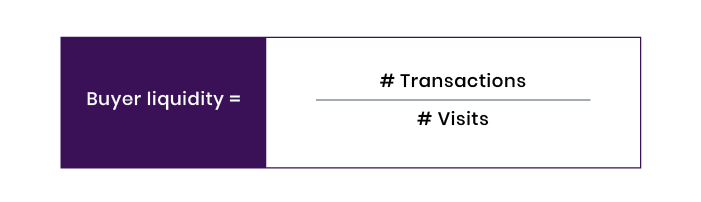

Buyer liquidity measures the possibility that a visit will lead to a transaction. A simple way to calculate your buyer liquidity:

Liquidity indicates the compatibility of your customers and vendors. Typically, a high percentage of sales within a short period of time means that sellers are earning money on a marketplace and buyers are happy with the value that sellers offer.

Wrapping up

Metrics are crucial to making sure a marketplace is on its way to success. Online marketplace metrics help you understand how many people visit your site, how you’re doing financially, and whether your business model is actually working. This marketplace KPI helps you understand where the biggest bottlenecks are that hold back the success of your online marketplace.

Subscribe to our newsletter for more useful insights about marketplace development!