-

Product Management

Software Testing

Technology Consulting

-

Multi-Vendor Marketplace

Online StoreCreate an online store with unique design and features at minimal cost using our MarketAge solutionCustom MarketplaceGet a unique, scalable, and cost-effective online marketplace with minimum time to marketTelemedicine SoftwareGet a cost-efficient, HIPAA-compliant telemedicine solution tailored to your facility's requirementsChat AppGet a customizable chat solution to connect users across multiple apps and platformsCustom Booking SystemImprove your business operations and expand to new markets with our appointment booking solutionVideo ConferencingAdjust our video conferencing solution for your business needsFor EnterpriseScale, automate, and improve business processes in your enterprise with our custom software solutionsFor StartupsTurn your startup ideas into viable, value-driven, and commercially successful software solutions -

-

- Case Studies

- Blog

How to Do Market Research: A-Z Guide for Startups

Information is a driver of evolution and success in any industry. If collected and appropriately structured, information about your target market can move you in the right direction. In addition, it can bring valuable insights about potential customers, competitors, current market demands, and future trends.

What does this mean for a startup? First of all, it means the ability to create a product or a service that is relevant to customers. Second, it means making grounded business decisions instead of guessing what will conquer the market.

In this article, you will find out how to conduct market research for a new business to minimize your risk of failure. Finally, you will get a complete market research tutorial for startups with the most effective methods we use in our practice.

What is market research?

Market research is the process of collecting and analyzing information about a target market, consumers within it, and competitors. It helps business owners understand how their products might exist within a particular environment and strategically plan their development.

Product market research is often considered the same as market analysis. While these terms are related, however, it would be inappropriate to consider them the same. Market research is focused on collecting and interpreting data for a specific market niche. It defines the best place for a product to enter the market. In contrast, market analysis provides a broader overview of a particular market sector or industry. It helps forecast potential outcomes in the long run through historical data and current trends.

Why is market research important for startups?

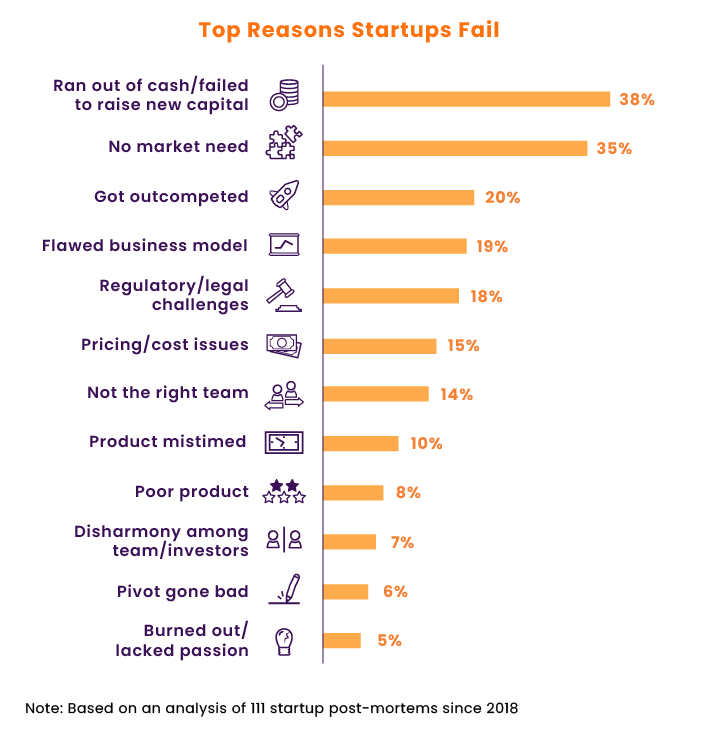

Almost all reasons for startup failure come down to a mismatch between product capabilities and customer expectations and demands. According to a CBInsights report from August 2021, the primary causes of startup failure are the following:

Market research can significantly reduce the above risks at the product ideation stage. It helps investigate what a customer expects to get from your product. However, the accuracy of those findings depends on how to conduct market research for a new product and how relevant your methods are.

If you plan to enter a niche with multiple similar products, the key is to discover your competitive advantages that may help you outpace competitors. A startup can hardly guess the right product development strategy without information about the current market situation, top products, their advantages, and disadvantages.

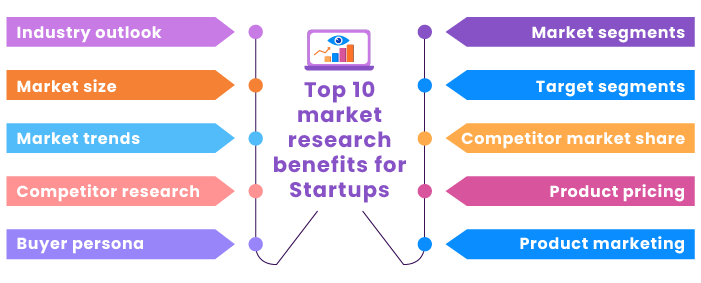

Market Research Outcomes

Research helps businesses understand their target audience and explore that audience’s behavior, pains, and needs. It also helps businesses define competitors for their products. Market research can reveal all these things or just some of them based on your initial intent.

How to Conduct Market Research for a New Product: Types and Methods

Market research is the right starting point for working on a startup product idea. You have a few options to conduct such research:

- Do it yourself

- Hire an in-house specialist

- Outsource it to a research agency or a freelance consultant

DIY research works well if you have enough expertise in marketing and clearly understand the required flow. However, hiring an in-house specialist is often an issue for a startup team aiming to minimize early-stage expenses.

On the other hand, hiring an outsourcing agency to conduct professional market research ensures accurate results and compliance with data protection and privacy laws. Regardless of which option you choose, it would be helpful to understand how to do market research for your future product and what methods are the most effective for startups.

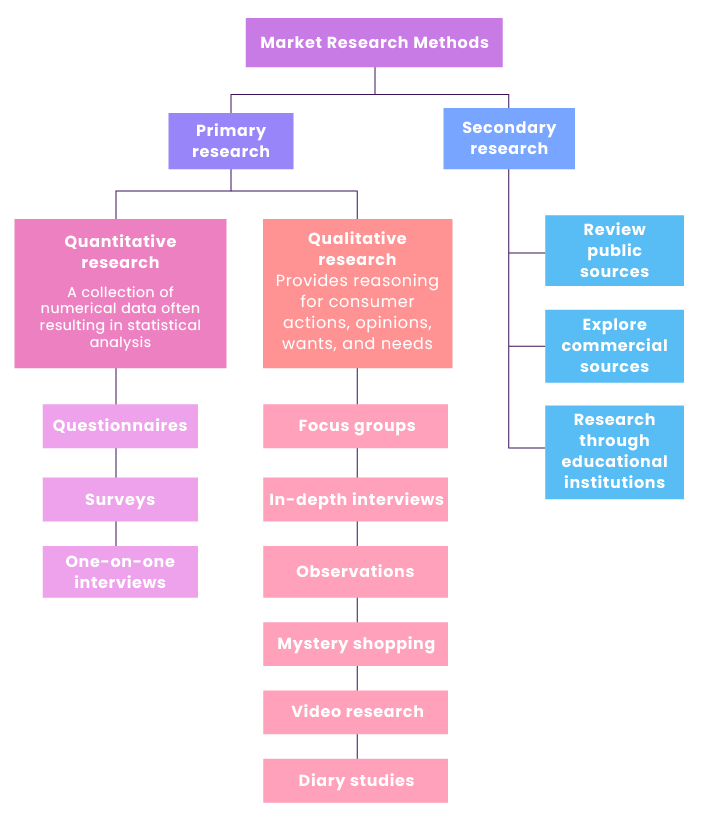

Primary Research

When conducting primary research, you collect required information by yourself (or hire a company/specialists to do it). Primary research methods are divided into two categories:

- Quantitative: Collecting numerical data for statistical analysis (in the case of a driving app, this could be preferred wait times, subscription prices, trip costs, etc.)

- Qualitative: Collecting information on what motivates specific consumer decisions, behavior, opinions, needs, and preferences (like preferred car models, notification types, etc. for the driving app.)

Qualitative research methods can include:

- Focus groups: Interviews with multiple people during one sitting. By creating a discussion between participants, you can see the differences between people in different categories, i.e. your customer types.

- In-depth interviews: Detailed interviews in-person or via video messaging platforms or phone, usually recorded for further analysis. As a rule, a researcher interviews up to 12 people to spot key personas and understand how they interact with a product or service you’re going to create.

- Observations: Observing participants’ behavior in realistic situations to get reliable insights regarding actual customer actions.

- Mystery shopping: Researching the customer experience with the help of hiring customers unknown to store staff. Mystery shoppers follow the plan set by the researcher to reveal aspects of the shopping experience.

- Video research: Filming customers giving their opinion in the chosen location or remotely via specialized platforms like Voxpopme.

- Diary studies: Collecting information by having participants log their everyday activities, experiences, or other aspects being studied.

The most popular quantitative product market research methods include:

- Questionnaires: Asking customers relevant questions to understand your target audience through a survey platform like SurveyMonkey or Google Forms.

- Surveys: Using questionnaires and other data collection methods to find out more about a target customer group. A researcher builds a statistical overview based on collected data to explore trends.

- One-on-one interviews: In one-on-one interviews, which are usually conducted via phone or messaging platforms, an interviewer collects information from each participant separately to collect answers and create a statistical report.

Secondary Research

Secondary research is based on data already collected by others, including reports, studies, and historical data. Sometimes this is called desk research. Here is how to conduct market research for a new product via secondary sources:

- Review public sources about your research subject (published market studies, government statistics, white papers, analyst reports, surveys including competitors’ findings, interviews, reports from specialized marketing agencies)

- Explore commercial sources (newsletters, pamphlets, magazines, trade publications, newspapers, and other paid sources)

- Research through educational sources (libraries, studies conducted in colleges and universities, coursework, etc.)

Data available on the internet is one of the most popular and cheapest ways of collecting secondary data. However, businesses need to consider only authentic, trusted sources to get accurate, meaningful results.

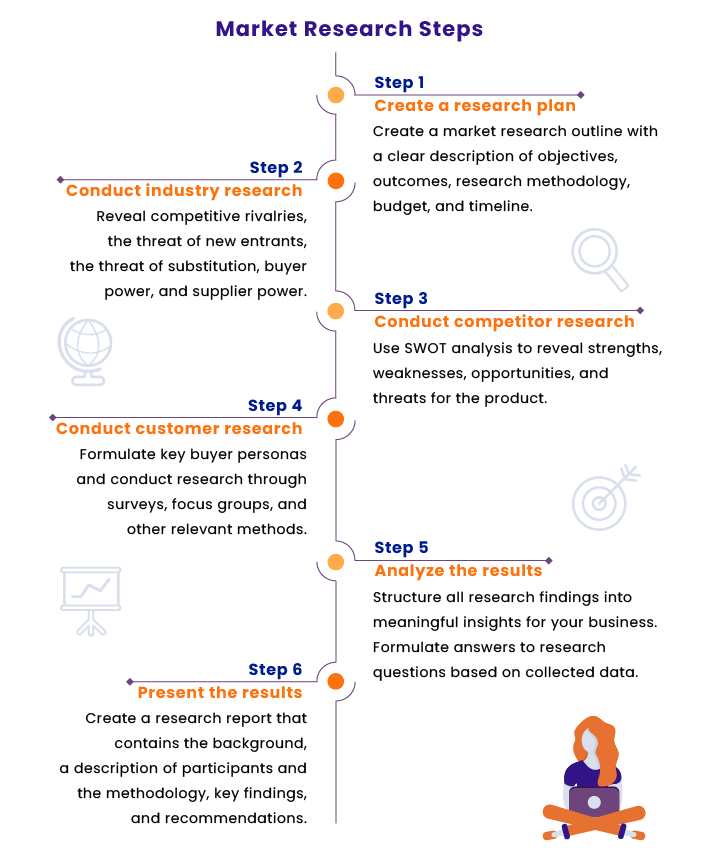

How to Conduct Market Research in 6 Steps

Market research requires a clear plan with a solid understanding of suitable methodologies to bring results that match your goals. Here is how to conduct market research to achieve these findings.

Step 1: Plan market research

To bring about results that match your goals, market research requires a clear plan with a solid understanding of suitable methodologies. The initial step is creating a research plan describing:

- Research objectives: Statements that outline specific results a team aims to achieve within the research process

- Deliverable outcomes: A list of deliverables you expect to receive at the end of the project

- Research methods: A list of methods for conducting research

- Timeline and budget: The amount of investment planned for research and the expected end date.

- Ethical and other considerations or issues that may arise during research.

Formulating such an outline at the beginning of your research helps you optimize resources and work directly towards the desired outcomes.

Step 2: Conduct industry research

Analyzing the state of the industry you’re going to enter helps you understand if it’s open for new market players and what’s missing to satisfy customer demand. In other words, you can reveal a suitable niche for your product. For that purpose, we recommend applying Five Forces Analysis, which includes the following aspects:

- Competitive rivalry: Define what other companies offer similar solutions in the niche or location in which you’re planning to do business. Evaluate the threats they impose on your market share.

- Threat of new entrants: Here, you can explore how difficult it is to launch a product that could potentially compete with yours and what barriers to entry exist.

- Threat of substitution: Research your product’s alternatives, including indirect substitutions. For instance, if you’re going to launch a new taxi ordering service, consider that consumers can use similar services or travel by public transport, car, bike, etc. People need to get to work or other destinations, yet they have many ways to do so.

- Buyer power: Analyze if your target market is a buyer’s market or a seller’s market from the business perspective. If buyers in your niche have no alternative to your product or a service (i.e. medicine or luxury cars), then the buyer power is relatively low. If your product has many options on the market, the buyer power is high.

- Supplier power: This defines how much suppliers influence the business. For instance, if gas and oil prices increase, any company that gets materials by car or plane will be affected. The supplier power is increased.

The more of the above categories are marked as “high,” the more difficult it will be to enter this market with your new product. Therefore, it also makes sense to analyze how dynamic your chosen industry is and how often it may change.

Industry research is highly resource-intensive, and startups may not have enough funding for this part of market research. Therefore, it makes sense to consult experts and companies who already have comprehensive knowledge of the field and can give you an overview of your market niche. The product managers and marketing experts at RubyGarage help startups translate industry analytics into business language by outlining important trends and favorable conditions for building and launching a new product in specific markets.

Step 3: Research your competition

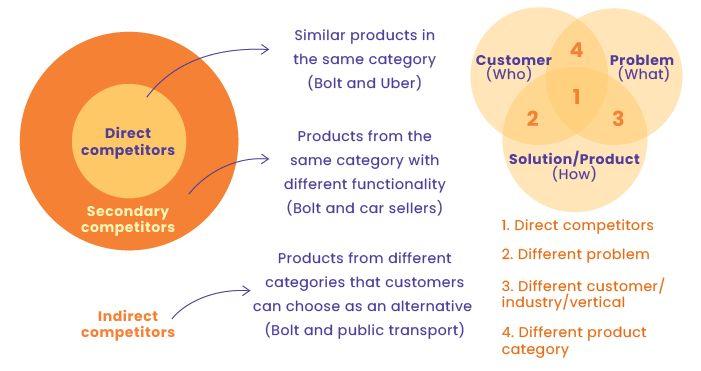

When researching similar solutions on the market, it would be helpful to segment competitors into three circles:

In the IT space, the core competition between products is performed by means of product features and usability instead of smart marketing approaches or brand communication to customers. Therefore, it is essential to see what features make direct competitors strong and form their unique customer value. You can also review the features of indirect competitors. Yet it doesn’t provide insights powerful enough to justify the resources and efforts required for an in-depth analysis.

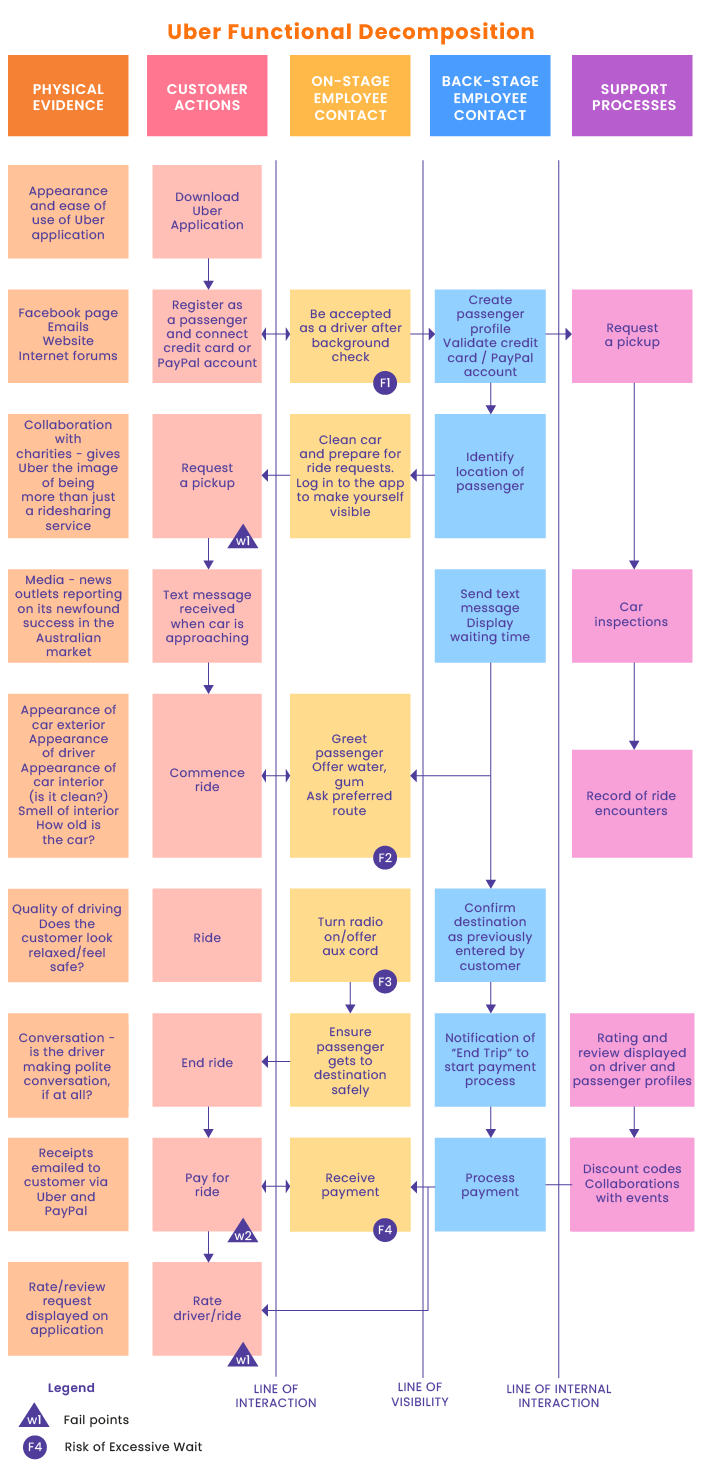

In the context of an IT startup, we recommend defining the top five direct competitors to perform a functional decomposition and analyze the killer features that help them win customers. This type of analysis defines how competitors reach their business goals at the functional level. It may help a startup avoid mistakes at the product design stage and adopt the best experiences from existing solutions. For example, a functional decomposition for Uber may look like the following (click on the image to expand it):

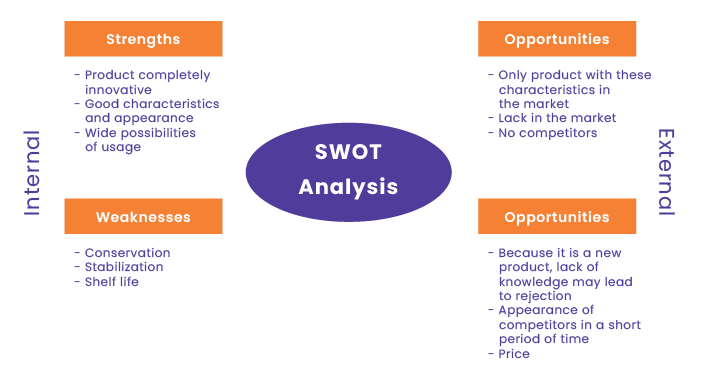

The next stage of the research is analyzing your company’s strengths and weaknesses, external opportunities, and threats to identify areas for strengthening your market position. If you’re looking for ways to conduct market research for a startup to minimize the risks of future competition, conduct a SWOT analysis to reveal the following:

- Strengths: The internal pros of your company (or team). These are usually unique for each startup and can be generally positive features that other market players also share.

- Weaknesses: These are internal faults that can affect the business in the short and long run. For a startup, they usually include a lack of reputation, funding, loyal audience, etc.

- Opportunities: These are external factors that bring you chances for business growth. Sometimes, they are negative changes to related industries or unoccupied service areas that you can jump in.

- Threats: These are external factors that can damage your success and affect profitability. For instance, consider the influence of other companies, government regulations, economic changes, social events, etc.

The result of SWOT analysis will show your company’s potential performance capabilities and give many insights on choosing the right marketing strategy.

Step 4: Conduct customer research

Besides analyzing where you may stand in your chosen industry, it’s vital to understand where you may stand in the eyes of your potential customers. All hypotheses and decisions regarding creating a new IT product are currently based on findings revealed during communication with real customers. Here are the key analytical approaches to do market research for product customers:

- Buyer personas: These are semi-fictional representations of your product’s target customers. After investigating different customer segments, we define those interested in the product and build a detailed profile of their pains, needs, intents, and other characteristics. This way, we know precisely for whom we are creating the product.

- Ideal customer profile (ICP): This is also a hypothetical representation of an ideal customer, yet at the company level. It describes the types of businesses and organizations you can sell your product to.

The above techniques generalize customer-related findings we collect using different research methods:

- In-depth interviews: This is one of the most representative methods to analyze the target audience and understand the real intent of users. The accuracy of your results highly depends on your choice of participants. In-depth interviews are conducted in person or remotely using video messaging services like Google Meet, Zoom, or Skype. We prefer remote interviews to in-person interviews, as they are cheaper and take less time.

- Customer discovery: This method helps to examine your assumptions regarding what your product should be like through communicating with potential buyers. It focuses on reviewing hypotheses focusing on four blocks of the lean canvas: customer segments, problem, solution, and value proposition. You can read more about the customer discovery method on the blog of Steve Blank, the founder of a science-based customer development methodology.

- Voice of customer (VOC): This method collects feedback from customers regarding their experience interacting with your brand and product to bridge the gap between buyers’ expectations and buyers’ real experiences. While building a new product vision, VOC research helps you check your hypotheses regarding what your product should look and feel like based on real users’ opinions. MonkeyLearn, Medallia, and other tools are used to automate the collection and classification of customer feedback through multiple channels.

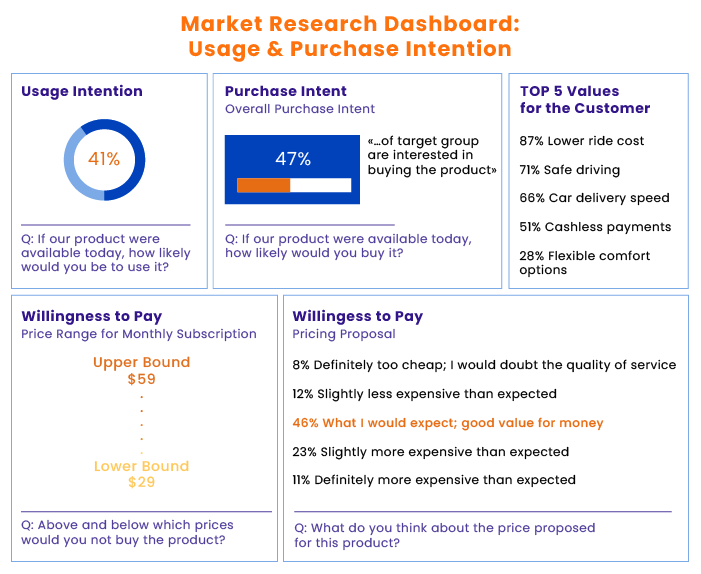

- Surveys: Multiple-choice, rankings, open-ended responses, and other survey types help define the character of your customers as well as their demands, habits, and expectations. You may ask survey takers questions about desired product qualities, competitors, etc. Using survey platforms like SurveyMonkey or Crowdsignal makes it easier to create surveys and analyze the results. You can also use Google Forms.

- Focus groups: This method helps you get more in-depth qualitative data from your target customers. If you already have a well-formed idea for your product, focus groups are the right approach to test your prototype and understand how people perceive it, what they would like to change, what price they are ready to pay, etc.

Your choice of research tools and approaches is not limited to those listed above. Instead, it depends on the goals of your product market research, your available budget, your time frame, and your business specifics.

Step 5: Analyze the results

Gathering information makes no sense without proper analysis. The core value of any research is extracting meaningful trends and insights from the collected data. If done correctly, market data analytics provides a startup with a clear vision for generating grounded hypotheses with the highest possible chances to meet market demand.

After receiving results from all research methods, analysts structure all findings and interpret them in the business context. In simple words, they find answers to the initial research questions.

Step 6: Present the results

The final step is presenting all findings in a structured, digestible form. The typical report delivery format is a presentation that includes the following sections:

- Background: A brief recap of the objectives, key research questions, and conditions

- Participants and methodology: A description of the research team, chosen methods, and research participants

- Key findings: A presentation of generalized research results in a question-by-question or theme-based layout

- Recommendations: Ideas of what to do next or how to change the existing strategy and product design flow based on research findings.

However, the report structure highly depends on the context. There is no one-size-fits-all approach to representing research findings. The essential rule is that the report content needs to directly answer the initial research questions formulated in Step 1 (research goals and outcomes).

Final Thoughts

Ideas for new products and businesses arise every day. Yet most of them fail due to an improper introduction to the market. Market research helps product owners and developers address customer needs in the right way and understand how to achieve the desired business results. Running well-thought-out, professional research is a must before diving into a new market. RubyGarage experts know how to conduct market research based on proven, reliable data to derive valuable insights for your startup project. Balance your potential with the best opportunities to make your startup idea win the market!

FAQ

-

Market research is the process of collecting and analyzing information about a target market, consumers within it, and competitors. It defines the best place for a product to enter the market.

-

Market research helps find out what customers need, what they currently lack in existing products, and what competitive advantages you can bring to the market.

-

It depends on your research goals. We recommend researching the niche you are going to enter, your direct competitors, and target audience. It will help find the right product-market fit.